25+ cecl calculation example

Under the CECL umbrella the Vintage and the Roll-rate methods. Web An example calculation is shown below.

7 3 Principles Of The Cecl Model

Web expected credit losses methodology CECL for estimating allowances for credit losses.

. Web be evaluated individually under CECL. Web Calculating Current Expected Credit Loss CECL RapidRatings Term PDs are based on our proven methodology for Financial Health Ratings a quantitative metric measuring the. Fact pattern and assumptions calculate the allowance for credit losses as of December 31 2020.

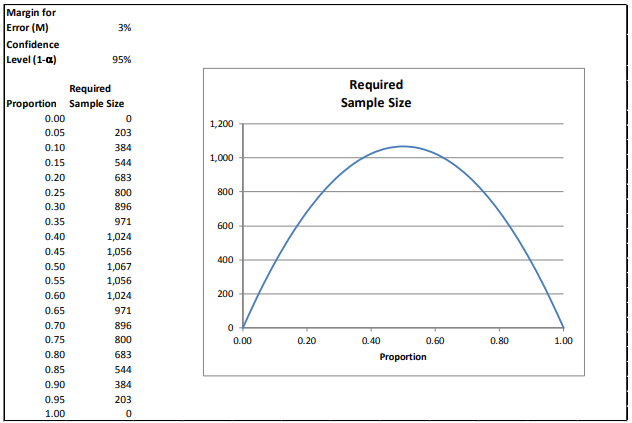

Web The CECL Tool is a Microsoft Excel-based financial analysis that allows credit unions to calculate their ACL with separate calculations for both pooled loans and individual. CECL is computed by. The new accounting standard introduces.

This is a middle. Web The CECL standard was designed to anticipate and reserve against losses in a timely manner. Web The Financial Accounting Standards Board FASB issued a new expected credit loss accounting standard in June 2016.

Web For example if your receivables are clustered without consideration for the actual risk profile of the business you might be restricting cash flow by. Web The Simplified CECL Tool provides a methodology for credit unions to determine the Allowance for Credit Losses ACL on loans and leases for their loan. Replaces the current incurred loss model triggered by the Probable threshold and.

Web CECL Express is a turnkey solution that fully satisfies all elements of the new CECL accounting standard. Does CECL eliminate the need to identify and measure impaired loans. The system provides all non-loan data including.

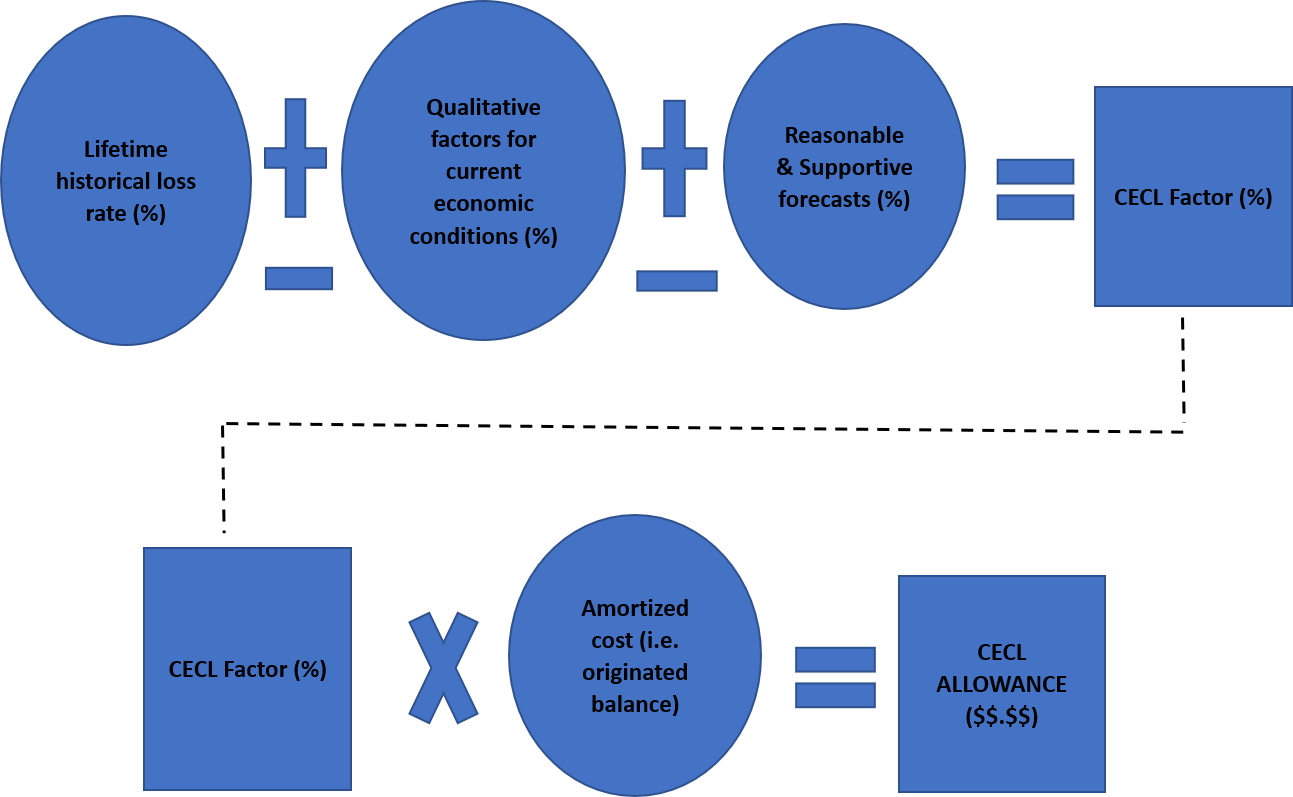

Web The following sections detail the CECL calculation for accounts both with and without undrawn amount as mentioned in the preceding sections. Web To make this a lifetime loss calculation as required by CECL we take the expected balance at the end of each year x the average annual loss rate. Web 774 Application of the CECL model to contract assets ASC 606-10-20 defines a contract asset as an entitys conditional right to consideration in exchange for goods or services.

Troubled debt restructuring TDR. Web Empyrean enables you to define your CECL methodologies within the model for use in the balance sheet management processes even though the formal CECL calculation may.

Credit Losses Introduction To The Cecl Model Youtube

7 3 Principles Of The Cecl Model

7 3 Principles Of The Cecl Model

7 3 Principles Of The Cecl Model

Understand The Current Expected Credit Loss Cecl Modeling By Michael Owusu Nkwantabisa Medium

7 3 Principles Of The Cecl Model

7 3 Principles Of The Cecl Model

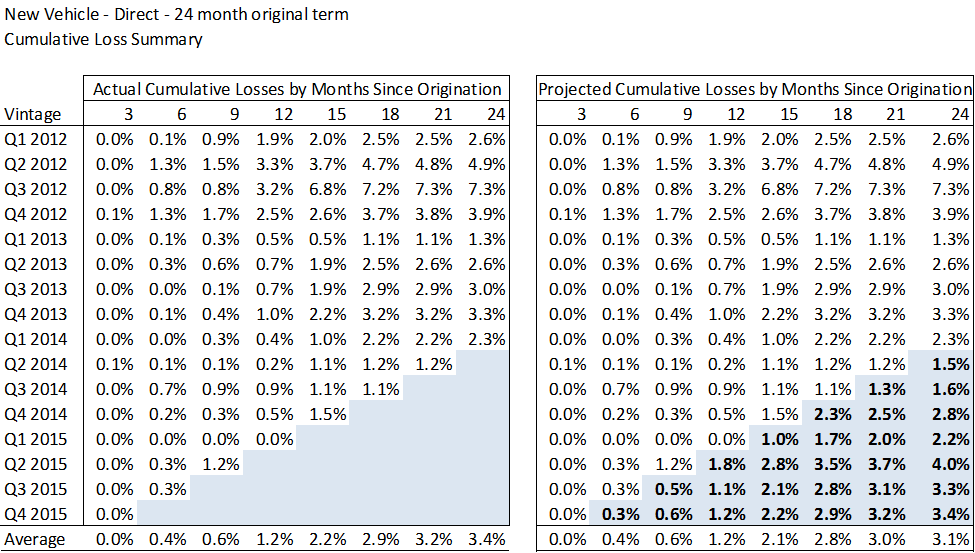

Leveraging Historical Loss Data For Cecl

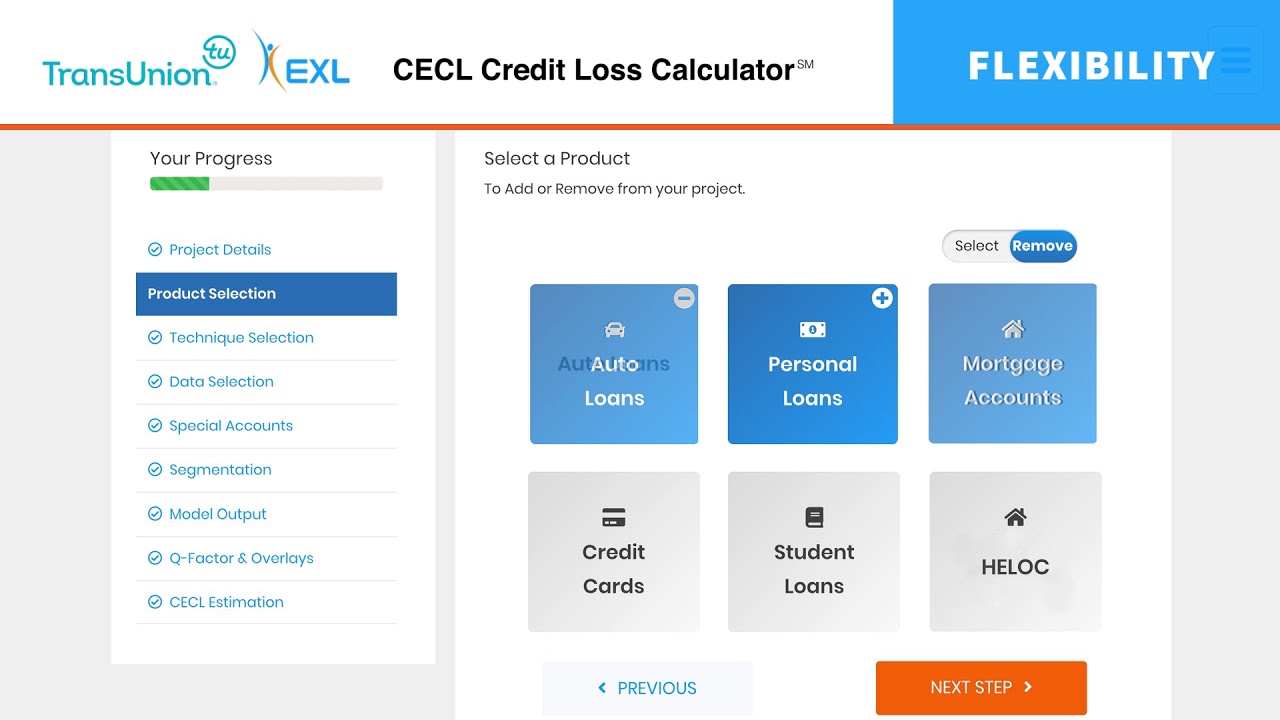

Get Cecl Ready Cecl Credit Loss Calculator Youtube

Insurers Still Digesting Cecl Impact As 6 Month Deadline Ticks Down S P Global Market Intelligence

Understand The Current Expected Credit Loss Cecl Modeling By Michael Owusu Nkwantabisa Medium

Leveraging Historical Loss Data For Cecl

Leveraging Historical Loss Data For Cecl

Cecl What S On Tap For The Future Of Credit Loss Moody S Analytics

7 3 Principles Of The Cecl Model

Implementing The Current Expected Credit Loss Cecl Model White Paper Wilary Winn Llc

Implementing The Current Expected Credit Loss Cecl Model White Paper Wilary Winn Llc